Happy Sunday,

Resource Nationalism - it is a buzz word that’s been doing the rounds for a while. Over the years it was all about oil and gas, and now ‘resource nationalism’ has well and truly reared its head in the world of climate change solutions.

As we debate climate solutions and innovate new ways to step away from fossil fuels, the new battle lines, are being drawn for the materials used to mark our shift to electrification - Those we call ‘Critical Minerals’ and Rare Earth Elements, including the likes of lithium.

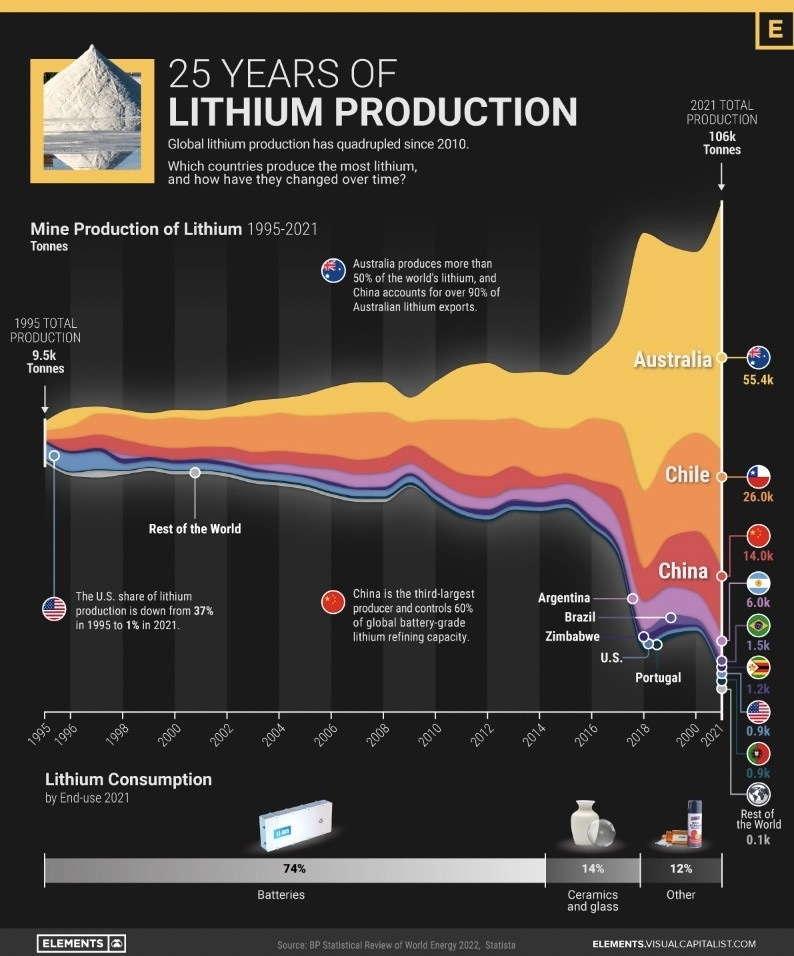

At the start of the year Indonesia banned the export of Nickle (also used in EV batteries). Last year Mexico nationalised its lithium mining, while Zimbabwe first nationalised Lithium and then went on to an even more blanket approach - outright banning the export of all base mineral ores unless with state approval. But let’s be honest Zimbabwe is tiny in the scheme of things - it only produces 1% of the world’s Lithium.

So, when the latest name to join the resource nationalism game is Chile - you have to sit up and take note. It is the world’s 2nd largest producer of Lithium — the stuff that’s key for your battery powered life after all!

The Global South’s making protectionist moves!

This week, Chile’s President Gabriel Boric declared he was going to nationalise its Lithium mining industry. The job to make that happen though, while keeping everyone calm (relatively) falls to Marcela Hernando, Chile’s mining minister. Since the proposal still has to make it through the country’s Congress, she may have the toughest, and frankly most critical job in government for now. Chile’s Congress has after all, shot down President Boric’s proposals seeking to implement reform and environmental regulations before. Read more at Financial Post

Chile’s Lithium output is currently restricted to just two companies — The world’s No. 1 producer Albemarle (which supplies the likes of Tesla) and the world’s No. 2 producer SQM (supplies the likes of LG Energy Solution). All from a single salt-flat in the Atacama Desert called Salar de Atacama. SQM's contract with Chile expires in 2030 and Albemarle's in 2043.

Marcela Hernando’s got quite the job ahead of her and a lot of people around the world to calm. How exactly is she going convince global mining companies, the battery producers and EV makers they supply, and importantly the Chilean taxpayer and the Congressional representatives —THIS IS THE WAY!

By the new nationalisation rules the mineral would belong to Chile and its people, rather than private sector miners. Per the President: “we present a national lithium strategy that's technically solid and ambitious.” And that it would build “a Chile that distributes wealth we all generate in a more just way.” Quite a fair proposal, if you think about who really should benefit from having something the world wants.

Marcela’s also been pushing for more sustainable ways to mine. Something a state-owned miner could potentially afford to implement, since the current commercial ways of mining for the stuff have serious environmental and social implications (especially for oft-ignored indigenous communities where these mines are). The current Lithium mining process is water heavy. Considering the deposits in Chile are located in the Atacama Desert, she is proposing selective processes that would mean far less evaporation of salt water from the ecologically sensitive desert. Read more at Yale Environment 360

If the nationalisation proposal goes through and becomes law that would mean — Future lithium contracts would only be issued as public-private partnerships with state control. A new state-owned company would be created and in-charge. Marcela and the government claim it would not terminate these current contracts but hopes companies would be open to state participation before the contracts expire.

Convincing legislatures that the state has the capacity, know-how and the ability to give Chileans a return on their investment is going to be key Vs. what private sector players currently contribute.

For the private miners, it opens a whole new and massive can of worms. Prices of Lithium were on a pretty exciting rising trajectory for the past 10 years. It created what many described as a ‘white gold rush.’ But prices did start falling toward the end of 2022 as demand from the battery market’s biggest customer (China) dropped. So, while figuring out where that graph is headed in the coming years, they now also have to sort out issues ranging from cost sharing and profits, to supply and production control, and the ability to meet global customer demands in case of shifting national interests.

It’s not going to be an easy ride for any of the parties involved. You can bet mining lobby groups are going to be busy hopping in and out of legislature offices in Santiago for the next few months. Getting face to face with Marcela - that’s going to be the golden ticket!

Fact box:

What’s Lithium used for?

Everything from bipolar medicines and lubricant grease for aviation, to the glass and ceramics industry. But its value has skyrocketed in the past decade as the source for our rechargeable battery powered life - from Electric Vehicles, to batteries of laptops, cell phones and other electronics.

What’s at stake?

A massively growing market as our rechargeable battery use increases! Demand for lithium is projected to reach 1.5 million tonnes by 2025 and over 3 million tonnes by 2030. That means production needs to triple by 2025 and increase 6-fold by 2030. Read more at World Economic Forum

Why Chile is important?

Chile is the world’s No. 2 lithium supplier, behind Australia. The “Lithium Triangle” is made up of Chile, Argentina, and Bolivia — together they hold more than 75 percent of the world’s supply beneath their salt flats.

What’s the environmental impact?

It harms soil and contaminates the air and the mining area’s water supply. Lithium extraction in the arid salt flats in the Lithium triangle consumes a huge amount of water (500 gallons per ton). That has massive implications in an area that barely has water. In Salar de Atacama, lithium extraction has consumed 65% of the region’s water supply. So extreme water shortages have resulted along with a substantial impact on the abilities of local farmers to grow crops and maintain livestock.

How’s the global north handling resource nationalism?

While demand from China may be slowing (feels temporary) for Lithium for example - they’ve already left wealthier western nations in the dust when it comes to access to it and other rare earths.

For example - Australia (the world’s biggest producer of Lithium) sends 90% of its production to China. By the way, China is also the world’s 3rd largest lithium producer. It also has a rather comfortable stake in SQM (the Chilean miner I mentioned above). So as much as it feels like the market is slowing, put China’s demand/supply into context and you get the geopolitical implications here!

It is therefore understandable that wealthier nations like the European Union whose entire economies are being steered toward a green future (batteries being key here) are worried about their dependence on third party countries, where they may lose control or the market. They therefore have their own paths to resource nationalism — via money, deals and legislations.

The European Commission’s Executive Vice President Margrethe Vestager has been busy on the deal circuit this month. She seems rather optimistic that an EV battery minerals trade agreement can soon be reached with the US.

The bloc (under the eagle eye of Commission President Ursula von der Leyen and her Commissioner Thierry Breton) is working on a proposal for ‘The European Critical Raw Materials Act’. It includes benchmarks for finding the stuff within the EU’s own borders (with high extraction, processing and recycling targets), making it simpler to get permits, access to finance and picking the projects. Perhaps most transparent in its aim, but important — the EU wants to “establish a critical raw materials club with partners to strengthen supply chains and diversify sourcing.” Read more at the European Commission

That’s how seriously they’re taking this new geopolitical and economic threat!

Lithium’s women - where are they?

I touched on the mining process and social and environmental impact/risks earlier, but I won’t get into the weeds. There are too many risks to list here and a topic for another day.

What I will leave you with is this critical point if you think of this magic metal that promises the moon when it comes to climate change:

3/5th of lithium miners have no female representation at all at the board level, according to Benchmark’s Lithium ESG report. The report points out “A total of 58% of lithium conversion companies and 34% of lithium mining companies have entirely male boards, and almost half don’t even report their boards’ gender makeup.”

Why is it an important point to note? Because the mining industry isn’t exactly lauded for its social or environmental benefits. Even less so when it comes to worker protections. But research tells us, a visible presence of women on company boards makes that company more sustainable, creates a safer working environment for workers and is better environmentally, socially and economically for the geographies in which they operate. Read more at PWC

So, until we get this right royal mess of ownership, supply and oversight sorted, and quickly - don’t expect EV batteries and their components to be the messiah saving our planet from doom!

In other news

Top Chef

Headed to Mexico City this year? Make sure you grab a meal at Rosetta, found in a beautiful mansion house in the city’s Roma district. It’s not just one of the most celebrated restaurants in Latin America, its chef and co-owner Elena Reygadas has just been named as The World’s Best Female Chef 2023. She voted the winner by 1,080 culinary experts from 27 regions across the globe who judge ‘The World’s 50 Best Restaurants 2023’ .

Elena is not just known for her delicious food, but also her work to promote greater gender parity in kitchens. Read more at The World’s 50 Best

U.K.’s new intelligence boss

Anne Keast-Butler has become the 17th and the 1st female director of the UK’s intelligence service GCHQ. The 104 year old GCHQ is the Government Communications Headquarters, one of the 3 UK Intelligence and Security Agencies, along with MI5 and the Secret Intelligence Service (MI6).

Anne is currently serving as deputy director general at MI5, will take up the post running the UK's intelligence service in May, succeeding Sir Jeremy Fleming who announced in January he would be stepping down after six years.Anne has previously worked for GCHQ as the head of counter-terrorism and serious organised crime. Read more at BBC